Top 10 Secured Credit Cards of 2025: Pros, Cons, and Key Features

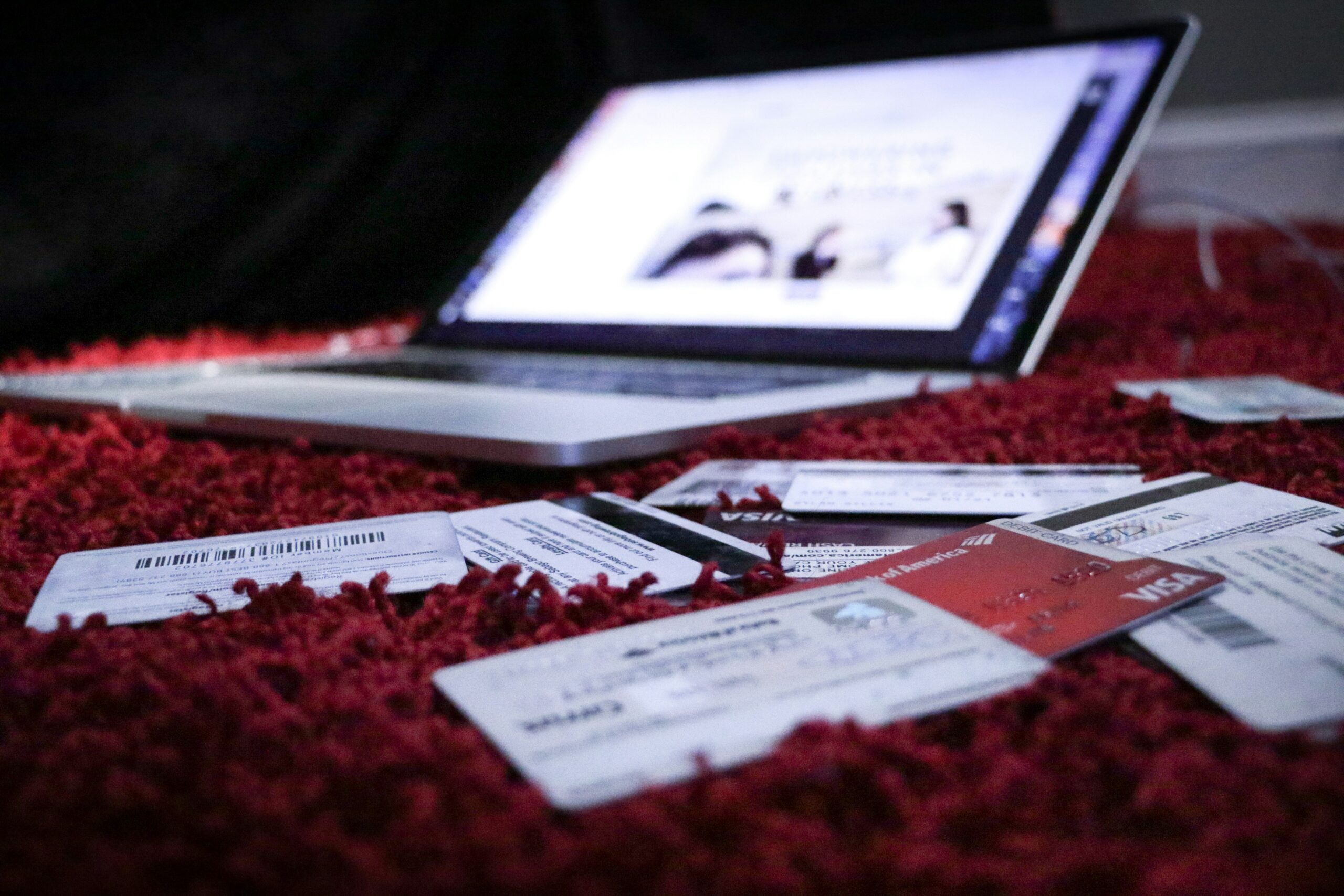

If you’re looking to build or rebuild your credit, secured credit cards can be one of the most effective tools available. Unlike traditional credit cards, secured cards require a refundable security deposit, which often determines your credit limit. This setup reduces risk for the card issuer, making secured cards accessible to individuals with no credit history or a damaged credit score. While some people shy away from secured credit cards due to the upfront deposit, they offer a structured and reliable way to establish responsible credit habits.

So why should you consider a secured credit card? For starters, they help you demonstrate financial responsibility. By paying your bills on time and keeping your balance low, you show creditors that you can handle debt effectively. Most secured credit cards report to all three major credit bureaus—Experian, Equifax, and TransUnion—which means your positive payment history and responsible use can help improve your credit score over time.

In addition to credit-building opportunities, some secured cards come with perks like rewards, low or no annual fees, and even the chance to transition to an unsecured card after a period of responsible use. The right secured credit card can serve as a stepping stone to better financial opportunities, including traditional credit cards, loans, and even mortgages.

However, not all secured credit cards are created equal. Some focus on accessibility, offering low or no credit check requirements, while others prioritize features like rewards programs or the ability to graduate to an unsecured card. Choosing the right card depends on your financial goals, whether you want to rebuild credit quickly, avoid annual fees, or earn rewards on your spending.

In this blog, we’ll explore the top 10 secured credit cards of 2024, analyzing their features, pros, and cons. Whether you’re new to credit cards or working to repair your financial standing, this guide will help you make an informed decision. By the end, you’ll understand the unique benefits of each card and how to use secured credit cards to set yourself up for long-term financial success.

Top 10 Secured Credit Cards of 2025

1. Discover it® Secured Credit Card

Intro Offer: Discover matches all cash back earned in the first year

APR: 27.74% Variable

Annual Fee: $0

Rewards Rate: 2% cash back at gas stations and restaurants (up to $1,000 in combined purchases quarterly); 1% on other purchases

Pros:

- No annual fee makes it affordable to maintain

- Offers a rewards program, rare for secured cards, with cash back on everyday purchases

- Potential to upgrade to an unsecured card after seven months of responsible use

Cons:

- High APR, which can be costly if you carry a balance

- Rewards for gas and dining are capped quarterly

2. Capital One Platinum Secured Credit Card

Intro Offer: None

APR: 29.99% Variable

Annual Fee: $0

Rewards Rate: None

Pros:

- Low minimum deposit requirements ($49, $99, or $200 for a $200 credit line) make it accessible

- Potential for automatic credit line increases with responsible use

- No annual fee keeps costs low

Cons:

- No rewards program, limiting ongoing value

- High APR, making it unsuitable for carrying a balance

3. Chime Credit Builder Secured Visa® Credit Card

Intro Offer: None

APR: N/A (no interest charges)

Annual Fee: $0

Rewards Rate: None

Pros:

- No credit check required, making it accessible to people with poor or no credit

- No minimum security deposit required, as the card is linked to a Chime Spending Account

- No interest charges ensure you won’t accrue debt

Cons:

- Requires a Chime Spending Account, limiting its use to Chime customers

- No rewards program

4. BankAmericard® Secured Credit Card

Intro Offer: None

APR: 26.24% Variable

Annual Fee: $0

Rewards Rate: None

Pros:

- No annual fee, keeping it affordable for users focused on rebuilding credit

- Reports to all three major credit bureaus, helping you establish a credit history

- Potential to graduate to an unsecured card

Cons:

- No rewards program

- High APR can be costly if you carry a balance

5. OpenSky® Secured Visa® Credit Card

Intro Offer: None

APR: 25.14% Variable

Annual Fee: $35

Rewards Rate: None

Pros:

- No credit check required, making it ideal for people with damaged credit histories

- Reports to all three major credit bureaus, helping you build credit over time

- Straightforward application process

Cons:

- $35 annual fee adds to costs

- No rewards program or perks

6. Citi® Secured Mastercard®

Intro Offer: None

APR: 26.24% Variable

Annual Fee: $0

Rewards Rate: None

Pros:

- No annual fee keeps costs low

- Reports to all three major credit bureaus

- Accessible to people looking to rebuild their credit

Cons:

- No rewards or incentives for spending

- High APR can be a burden if you carry a balance

7. Capital One Quicksilver Secured Cash Rewards Credit Card

Intro Offer: None

APR: 29.99% Variable

Annual Fee: $0

Rewards Rate: 1.5% cash back on all purchases; 5% cash back on hotels and rental cars booked through Capital One Travel

Pros:

- Earns flat-rate cash back on all purchases, a unique feature for secured cards

- No annual fee

- Potential to upgrade to an unsecured card with responsible use

Cons:

- High APR makes carrying a balance expensive

- Requires a security deposit

8. Self Visa® Credit Card

Intro Offer: None

APR: 28.74% Variable

Annual Fee: $25

Rewards Rate: None

Pros:

- No credit check required, making it accessible to individuals with poor or no credit

- Helps build credit through a linked Credit Builder Account

- Reports to all three major credit bureaus

Cons:

- $25 annual fee adds to costs

- No rewards program

- Requires opening a separate Credit Builder Account

9. First Progress Platinum Elite Mastercard® Secured Credit Card

Intro Offer: None

APR: 24.99% Variable

Annual Fee: $29

Rewards Rate: None

Pros:

- Reports to all three major credit bureaus, aiding in credit building

- Relatively low APR for a secured credit card

- Straightforward application process

Cons:

- $29 annual fee adds to costs

- No rewards program

10. U.S. Bank Secured Visa® Card

Intro Offer: None

APR: 26.99% Variable

Annual Fee: $0

Rewards Rate: None

Pros:

- No annual fee keeps it budget-friendly

- Potential to graduate to an unsecured card after consistent responsible use

- Reports to all three major credit bureaus

Cons:

- No rewards program

- High APR, which is less suitable for those who may carry a balance

Final Thoughts On The Top 10 Secured Credit Cards of 2025

Secured credit cards are powerful tools for individuals looking to establish or rebuild their credit. By providing access to credit while requiring a refundable deposit, they minimize risk for issuers and open doors for consumers to improve their financial standing. Each of the top 10 secured credit cards listed here offers unique benefits, making it easier for users to find a card that matches their specific needs and financial goals.

For those seeking to earn rewards while building credit, options like the Discover it® Secured Credit Card and Capital One Quicksilver Secured Cash Rewards Credit Card stand out. These cards offer cash-back programs on everyday purchases, providing tangible value alongside credit-building opportunities. While most secured cards don’t offer rewards, these exceptions make it possible to maximize your spending while improving your credit.

If affordability is your main concern, consider no-annual-fee options like the Citi® Secured Mastercard®, U.S. Bank Secured Visa® Card, or BankAmericard® Secured Credit Card. These cards are cost-effective and ideal for users who want to rebuild credit without added expenses. Additionally, their straightforward features make them accessible to those new to credit cards.

Accessibility is another critical factor for many users, and cards like the Chime Credit Builder Secured Visa® Credit Card and OpenSky® Secured Visa® Credit Card shine in this area. With no credit check required, these cards offer a lifeline to those with poor or no credit histories. The Self Visa® Credit Card, with its unique linked Credit Builder Account, also provides a practical and innovative way to establish credit.

It’s important to note that responsible use is the foundation of success with secured credit cards. Always pay your balance on time, keep your credit utilization low, and monitor your credit report regularly. Over time, these habits will help you build a positive credit history, paving the way for better financial opportunities.

While secured credit cards are not a permanent solution, they serve as a stepping stone toward unsecured credit cards, higher credit limits, and lower interest rates. Some of the cards on this list, such as the Discover it® Secured Credit Card and Capital One Platinum Secured Credit Card, even allow you to graduate to an unsecured card, making them ideal for long-term growth.

Ultimately, the best secured credit card for you depends on your individual financial situation and goals. Whether you’re focused on earning rewards, avoiding fees, or simply gaining access to credit, there’s a secured card that meets your needs. By making an informed choice and committing to responsible credit management, you can turn your secured card into a tool for financial success. Take control of your credit journey today and invest in your financial future!