Credit Card Debt: Why It’s Important to Pay Off and How to Do It

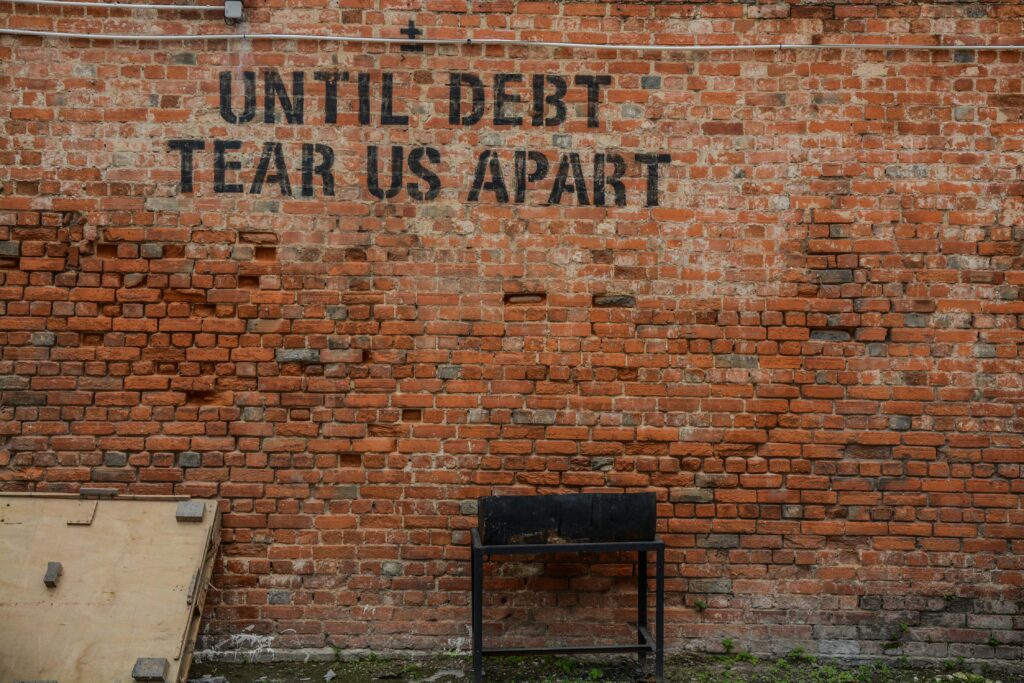

Credit card debt is one of the most common financial challenges faced by individuals today. With their convenience and accessibility, credit cards can feel like a financial safety net, but they can quickly spiral into overwhelming debt if not managed responsibly. According to recent studies, millions of people carry high credit card balances, often paying exorbitant interest rates that make repayment a daunting task.

Understanding how people fall into credit card debt is the first step toward avoiding it. But if you’re already dealing with mounting balances, it’s crucial to recognize why paying off that debt is essential for your financial well-being. Whether it’s saving money on interest, improving your credit score, or reducing financial stress, the benefits of tackling credit card debt are immense.

In this comprehensive guide, we’ll explore the most common reasons people fall into credit card debt, the benefits of paying it off, and actionable strategies to become debt-free. By the end, you’ll have a clear roadmap to take control of your finances, improve your credit health, and work toward financial freedom.

How People Fall Into Credit Card Debt

Credit card debt doesn’t happen overnight—it’s often the result of a combination of financial habits, unexpected expenses, and lack of knowledge about how credit works. Here are the most common ways people fall into credit card debt:

1. Living Beyond Their Means

Many people use credit cards to fund lifestyles they can’t afford, often making unnecessary purchases for luxury items, dining out, or vacations. This overspending can quickly lead to large balances that are hard to pay off.

Example: Charging $5,000 on a vacation without a plan to pay it off, resulting in years of interest payments.

2. Relying on Credit for Emergencies

Without an emergency fund, many people turn to credit cards when unexpected expenses arise, such as medical bills, car repairs, or job loss. While credit cards can be a lifeline, the high interest rates can make repayment difficult.

Example: A $2,500 car repair charged to a credit card at 20% APR can add hundreds in interest if paid off slowly.

3. Making Only Minimum Payments

Paying only the minimum amount due each month allows balances to accumulate and grow significantly over time due to compounding interest.

Example: A $10,000 balance with a 20% APR could take decades to pay off with minimum payments, costing thousands in extra interest.

4. Impulse Spending

Credit cards make it easy to spend without thinking. From flash sales to late-night online shopping, impulse purchases can pile up quickly.

Example: A $1,000 shopping spree that wasn’t budgeted for can turn into long-term debt if not paid off immediately.

5. Medical Expenses

Even with insurance, many people face high out-of-pocket medical costs. Using credit cards to pay these bills often feels like the only option.

Example: A $10,000 surgery could leave someone with significant credit card debt, especially if they don’t have a repayment plan.

6. Job Loss or Income Reduction

Losing a job or experiencing reduced income often forces people to rely on credit cards to cover essential expenses, such as rent, utilities, and groceries.

Example: Charging $3,000 in monthly living expenses during a period of unemployment can quickly accumulate into unmanageable debt.

7. Misunderstanding Credit Card Terms

A lack of understanding about interest rates, fees, and how credit works can lead to financial mistakes that result in debt.

Example: Assuming that paying the minimum balance avoids interest charges can lead to balances growing faster than expected.

Why It’s Important to Pay Off Credit Card Debt

Paying off credit card debt isn’t just about freeing yourself from monthly payments—it’s a crucial step toward achieving financial health and long-term stability. Here’s why:

1. Save Money on Interest

Credit card interest rates are often in the double digits, meaning a significant portion of your payments goes toward interest rather than the principal balance. Paying off your debt reduces these costs.

Example: Clearing a $10,000 balance at 20% APR saves approximately $2,000 annually in interest.

2. Improve Your Credit Score

High credit utilization (the percentage of your available credit you’re using) negatively impacts your credit score. Paying down debt lowers your utilization rate, boosting your score and improving your access to better financial products.

3. Reduce Financial Stress

Debt is one of the leading causes of financial anxiety. Paying it off provides peace of mind and allows you to focus on other financial goals.

4. Increase Financial Freedom

Without debt, you can redirect your income toward savings, investments, or discretionary spending, giving you more control over your money.

5. Avoid Long-Term Debt Cycles

Carrying credit card debt can trap you in a cycle of minimum payments and high-interest charges. Paying it off breaks this cycle, freeing you to build a more secure financial future.

How to Pay Off Credit Card Debt

Now that we’ve explored why it’s essential to pay off credit card debt, let’s look at actionable strategies to tackle it:

1. Create a Budget

Start by assessing your income and expenses. Identify areas where you can cut back and allocate extra funds toward your credit card payments.

Example: Reduce dining out from $200 per month to $50, putting the remaining $150 toward your debt.

2. Choose a Repayment Strategy

Snowball Method: Focus on paying off the smallest balances first for quick wins while making minimum payments on larger debts. Avalanche Method: Target the card with the highest interest rate first to save the most on interest.

Example: Pay off a $1,000 card at 20% APR before tackling a $5,000 card at 15% APR if using the avalanche method.

3. Consolidate Debt

Consider a personal loan or balance transfer credit card with a lower interest rate to simplify payments and reduce interest costs.

Example: Transfer $10,000 of debt from a card with a 25% APR to a balance transfer card with a 0% APR for 18 months, saving significant interest. One of our favorites is the Wells Fargo Reflect Card.

4. Increase Your Income

Pick up a side hustle, freelance work, or sell unused items to generate extra cash to pay down your debt faster.

Example: Earning an extra $500 per month delivering food can help pay off a $6,000 balance in just over a year.

5. Automate Payments

Set up automatic payments for at least the minimum amount to avoid late fees. Schedule additional payments to accelerate repayment.

6. Stop Using Your Credit Cards

Freeze or stop using your cards while you’re paying off debt. Switch to cash or debit to prevent adding to your balances.

7. Negotiate with Creditors

Contact your credit card issuer and request a lower interest rate. Many companies are willing to accommodate if you have a good payment history.

Have A Plan To Become Debt Free

As you embark on this journey, it’s essential to have a plan. Start by creating a budget that outlines your income, expenses, and opportunities to cut back on non-essential spending. Use this extra money to prioritize paying down your highest-interest debts first, a strategy that will save you the most money in the long run. If you need help staying organized, consider using budgeting apps or working with a financial advisor to create a personalized plan.

Remember that every small step counts. Whether you’re making additional payments, increasing your income through a side hustle, or consolidating debt with a lower-interest loan, each action brings you closer to your goal. Celebrate your progress along the way to stay motivated—paying off even one credit card is a significant accomplishment.

The journey to becoming debt-free may not be easy, but it’s one of the most rewarding financial goals you can achieve. It gives you the power to regain control over your finances, improve your quality of life, and work toward a brighter, more secure future. Start today, take it one step at a time, and remember that the rewards of financial freedom are well worth the effort. With determination and a solid plan, you can break free from credit card debt and create the financial stability you deserve.

Finally, once you’re debt-free, make a commitment to yourself to stay that way. Build an emergency fund to avoid relying on credit cards for unexpected expenses. Use credit responsibly by paying off balances in full each month and living within your means. These habits will help you maintain your financial health and prevent future debt from creeping in.

Final Thoughts On Paying Off Credit Card Debt

Credit card debt is a significant financial challenge, but it’s not insurmountable. Understanding how debt accumulates—whether from overspending, emergencies, or lack of knowledge—can help you avoid common pitfalls. If you’re already in debt, paying it off is one of the best decisions you can make for your financial future. It not only saves you money on interest but also improves your credit score, reduces stress, and gives you greater financial freedom. However, the journey to becoming debt-free requires a thoughtful approach and consistent effort.

Paying off credit card debt starts with recognizing the importance of the task. High-interest rates mean that even small balances can quickly balloon into significant financial burdens if left unchecked. By eliminating this debt, you save yourself potentially thousands of dollars in interest over time. More importantly, you free up your monthly income for things that truly matter, such as saving for retirement, investing in your future, or enjoying life’s experiences without the shadow of financial stress hanging over you.

One of the greatest benefits of paying off credit card debt is the positive impact it has on your credit score. A lower credit utilization rate not only boosts your score but also improves your eligibility for favorable financial products in the future, such as mortgages, car loans, or personal loans with lower interest rates. A strong credit score is a gateway to financial opportunities, and paying off your credit card balances is one of the fastest ways to achieve it.

Another powerful motivator is the peace of mind that comes with being debt-free. Debt can be a source of constant worry, affecting not just your finances but also your mental and emotional well-being. The stress of juggling payments, managing high-interest rates, and feeling trapped in a cycle of debt can be overwhelming. By taking steps to eliminate your credit card debt, you remove a significant source of anxiety and gain clarity and confidence in your financial life. Take charge of your finances now—you’ve got this!