7 Smart Investment Strategies for 2025: Where to Put Your Money Now

With today’s ever-shifting financial landscape, investing wisely is more crucial than ever. If you’re looking to make the most of your money, now’s the time to understand which investments hold the best potential for growth. Here, we’ll dive into some of the most promising strategies for 2025, so you can make informed decisions about where to allocate your funds.

7 Smart Investment Strategies for 2025

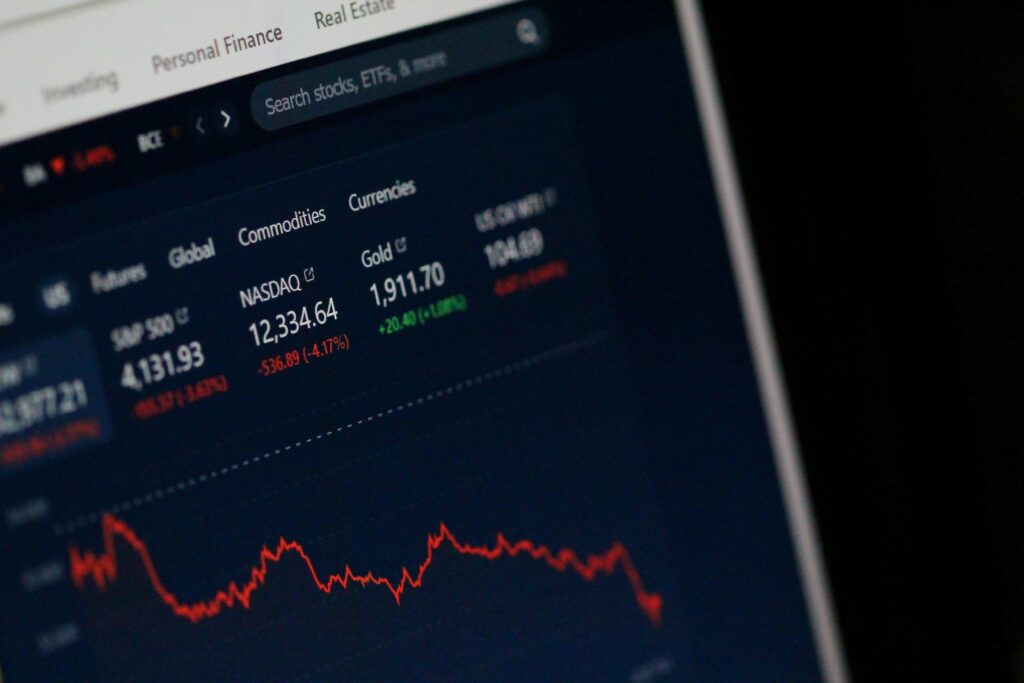

1. Stock Market – Focus on Growth and Stability

The stock market remains a powerful way to grow wealth, especially if you diversify and choose sectors with long-term growth potential. While tech stocks have been a long-time favorite, they’re becoming saturated, and newer opportunities lie in renewable energy, biotechnology, and e-commerce. Companies focusing on these areas are likely to see steady growth over the next decade as the global economy moves toward sustainability, healthcare advancements, and digital commerce.

- Blue-Chip Stocks: These well-established, financially sound companies like Apple, Microsoft, and Johnson & Johnson offer stability. They may not have rapid growth, but their reliability and dividends make them a safer bet.

- Emerging Markets: Investing in international stocks, particularly in emerging markets like India and Southeast Asia, can yield high returns, given the rapid economic growth in these regions.

2. Exchange-Traded Funds (ETFs) – Balance and Diversity in One

ETFs have become a popular investment vehicle due to their low fees, diversification, and ease of access. Unlike individual stocks, ETFs represent a basket of stocks, bonds, or other assets, which can spread out risk. They’re also more affordable for new investors.

- Thematic ETFs: Look into ETFs focused on trends like clean energy, AI, or cybersecurity, as they’re likely to be integral to future infrastructure.

- Dividend ETFs: For those looking for income as well as growth, dividend-focused ETFs are a solid choice, as they provide regular payouts from companies within the fund.

3. Real Estate – Physical and Digital

Real estate has always been a preferred asset for long-term stability and wealth accumulation. With technology evolving, real estate investing now includes digital options as well.

- Residential and Commercial Properties: Traditional real estate offers the benefits of rental income and appreciation. While interest rates may be higher than previous years, there are still opportunities in high-demand areas.

- REITs (Real Estate Investment Trusts): If you want exposure to real estate without buying property, REITs are an option. They allow you to invest in real estate portfolios and provide dividends, with a focus on properties that range from malls to hospitals to warehouses.

- Metaverse Real Estate: For those interested in digital investments, the metaverse offers a new frontier. Virtual land in popular metaverse platforms like Decentraland or The Sandbox has become valuable, though it’s a speculative and high-risk area.

4. Bonds – Safer Investment with Predictable Returns

Bonds are known for providing more stability compared to stocks. While they may not have the same potential for high returns, they’re a safer investment, especially during economic uncertainty.

- Treasury Bonds: Government-issued bonds are low-risk and provide guaranteed returns, though at a lower interest rate.

- Corporate Bonds: Issued by companies, these bonds offer higher returns than treasury bonds, though with slightly higher risk. Look for bonds from reputable companies if you want a safer bet.

5. Cryptocurrency – High Risk, High Reward

Cryptocurrencies remain highly speculative, but they’ve carved out a niche for investors looking for high-growth potential. While Bitcoin and Ethereum are still the go-to options, newer projects like Solana and Cardano offer unique advantages and lower entry costs. For those willing to take on the risk, crypto investments could yield high returns, especially if you’re willing to “HODL” (hold on for dear life) through market volatility.

- Bitcoin (BTC): As the largest and most established cryptocurrency, Bitcoin remains a strong choice for crypto exposure.

- Ethereum (ETH): Known for its smart contracts, Ethereum is not only a currency but a blockchain platform. With its recent move to proof-of-stake, it’s also more energy-efficient, making it attractive to eco-conscious investors.

Note: Consider only a small percentage of your portfolio in cryptocurrency to balance the risk.

6. Alternative Investments – Art, Wine, and Collectibles

For those seeking diversification outside traditional assets, alternative investments like art, wine, and collectibles are gaining traction. Online platforms such as Masterworks allow you to buy shares of fine art, while others offer wine or collectible assets. These investments are not correlated to the stock market and can provide a hedge against inflation. Keep in mind, however, that they are long-term and require patience.

7. Emergency Fund and Cash Investments

Before diving into higher-risk investments, it’s wise to keep an emergency fund. A good rule of thumb is to set aside three to six months of living expenses in a high-yield savings account. While interest rates are still low, some banks are now offering more competitive rates for online savings accounts, which can add up over time.

- Certificates of Deposit (CDs): For more stability, CDs lock in your money for a set term at a higher interest rate than a savings account.

- Money Market Accounts: These accounts offer slightly better returns than regular savings accounts and allow limited withdrawals, adding a level of flexibility.

Final Tips for Smart Investing

While there’s no one-size-fits-all approach to investing, keeping a balanced portfolio can help manage risk and improve your chances of achieving steady returns. Here are a few tips:

- Diversify: Spread your investments across different assets and sectors. Diversification reduces your exposure to any single asset, helping to smooth out returns over time.

- Review Regularly: Investment strategies may need adjustment as markets shift. Make it a habit to review your portfolio at least annually.

- Avoid Emotional Decisions: Investing can be stressful, especially when markets are volatile. Stick to your plan and avoid making impulsive changes based on short-term market fluctuations.

By aligning your investments with your financial goals and risk tolerance, you’ll be well on your way to making smarter financial decisions in 2025. Happy investing!